This Chinese weakness has negative implications for companies like Otis, whose most profitable market for new equipment sales is China. In fact, China accounted for about one-third of Otis' orders last year. During the first half of this year, China was the only major market where orders were declining for the company. However, since Otis manufactures its elevators in China, the impact of the property market slump will be felt more in their Chinese facilities rather than in the United States. China's economic troubles are not contagious to the extent that it significantly affects other countries' production of goods for China.

According to Brad Setser, a former trade adviser to the Biden administration, China's slowdown will have relatively modest direct effects. Whether China grows at zero or 5% does not matter much to the export side of the US economy. However, if China's slowdown proves worse than expected or if the government artificially devalues its currency to boost exports at the expense of trading partners, it could have a more significant impact on global financial markets.

Nevertheless, economists believe that China's slowing economy will only shave off a few tenths of a percentage point from global growth. This can be seen in China's trade in manufactured goods, which only accounts for 3.5% of its GDP when used domestically rather than for making products for other countries. Additionally, China's reliance on foreign factories has decreased by about one-third since Xi Jinping became the country's leader in 2012 and pursued self-sufficiency.

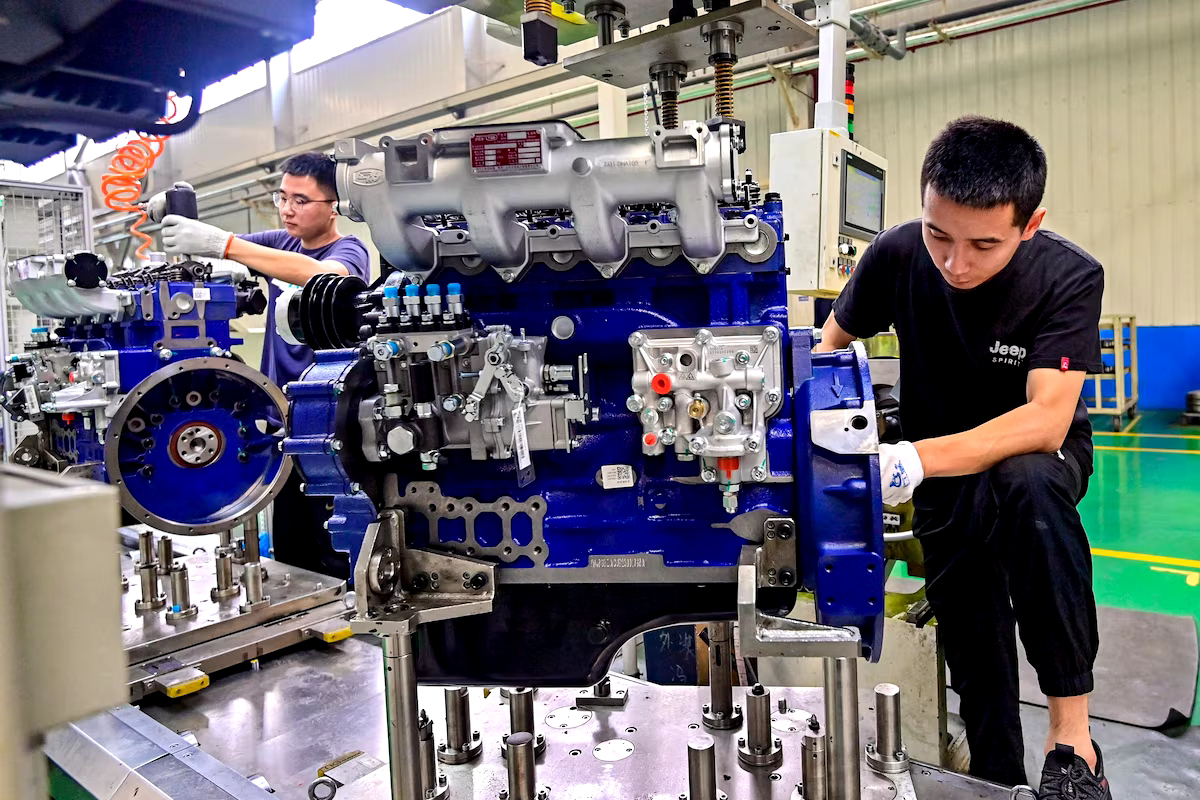

Otis, which has plants in Tianjin and near Shanghai, has been operating in China since the mid-1990s. While the property market slowdown has affected new equipment orders, demand for servicing existing units remains strong. Marks stated in July that Otis reported higher quarterly sales and earnings.

A prolonged or deeper downturn in China would have global repercussions. Major commodity producers would be the first to suffer, as China has been a significant consumer of copper, ore, soybeans, and oil. Although direct financial links between the US and China have decreased due to trade tensions, a severe Chinese slump could trigger a negative feedback loop, leading to falling stock and bond prices, increased volatility, and a stronger dollar. This would undermine consumer and business confidence not only in the US but also globally.

A potential fallout from the 2015 Chinese stock market crash could have significant implications for global and U.S. economic growth, according to Gregory Daco, the chief economist at EY-Parthenon. The key concern is whether the shock in China's economy will lead to a broader deterioration in global financial conditions. China's neighbors are already experiencing a decline in exports to China, primarily due to reduced demand for electronics from American consumers during the pandemic. China plays a central role in the pan-Asian electronics supply chain, assembling products with components from South Korea, Malaysia, Thailand, and Taiwan. Multinational corporations that rely on the Chinese market, such as BMW and Intel, would also be affected. While China has been a major driver of global economic growth, its old growth model based on heavy investment in public infrastructure and housing has reached its limits. Chinese leaders have expressed intentions to shift towards an economy driven by consumer spending and service industries, but this transition is still in progress. The current slowdown highlights a shift in China's global image, as its vast domestic market is no longer as attractive to multinational corporations. China's economic growth has slowed, with an annual pace of just above 3 percent in the second quarter, compared to an average of around 9 percent over the past three decades. Its aging labor force and emphasis on loyalty to the Communist Party have contributed to these challenges. Some U.S. business executives have even described China as "uninvestable" due to the government's erratic treatment of foreign businesses. While China is expected to contribute a significant portion of global growth this year, economists argue that this figure overstates its impact on trading partners. China runs a trade surplus with the rest of the world, selling more than it buys, and its exporters dominate global markets for various products. However, Chinese consumers tend to save rather than spend their income on foreign goods. As major central banks raised interest rates to cool inflation, foreign demand for Chinese goods declined, leading to a widening trade surplus. Ultimately, China's economic growth primarily benefits its own economy rather than contributing significantly to global growth.

Exports have played a crucial role in China's economic strategy for many years, with the export sector contributing over one-fifth of the country's annual economic growth in the past three years. However, despite hopes for an economic boom driven by domestic consumption, Chinese factories, consumers, and real estate developers are currently facing a slump. The Chinese government has implemented measures such as cutting interest rates to revive growth, but these efforts have been largely ineffective. With a high unemployment rate among young people, there is a growing risk of social unrest. One option that Beijing has not yet pursued is manipulating the value of its currency, the yuan. The yuan has already fallen 5 percent against the dollar this year, reflecting slower growth and lower interest rates in China. By further devaluing the yuan through selling it on global markets, Chinese goods would become cheaper for customers paying with dollars and euros, potentially boosting export earnings and domestic employment. However, this move would likely worsen already strained relations with the United States and Europe. While there is currently no indication that China plans to take this step, if the economic situation continues to deteriorate, they may consider it. In the past, China has kept its currency undervalued for years, leading to complaints from the US government and American businesses.

.jpg)